The Hidden Benefits of Renting

“Renting is waste of money!” “It’s cheaper to own than to rent!” I am sure this is something we have all probably heard at one point in time. Before you assume anything, this post will not be bashing renting or owning. Ultimately, this great debate really boils down to personal preference (e.g. area you want to live, how long you plan to live in an area, affordability).

When it comes to renting, some of the main benefits that people tend to speak on is the flexibility to move around, affordability to live in a high-cost area, amenities, no maintenance cost and ultimately less risk if a financial burden were to occur. On the flip side, homeownership has advantages such as the ability to build equity, privacy, more stable housing cost and I think everyones favorite, the tax benefits.

However, when it comes to renting there are some costs that are able to be avoided. Cost such as the downpayment on a property, annual property taxes, home insurance, maintenance cost, Mortgage Protection Insurance and lastly, the cost of borrowing for a mortgage.

Considering that these extra costs can be invested as a renter, that is when things actually get quite interesting.

It’s time to discuss the hidden benefits of renting and how renters can still build MASSIVE wealth in the process. Like I always say, numbers do not lie.

Renting vs Owning Analysis

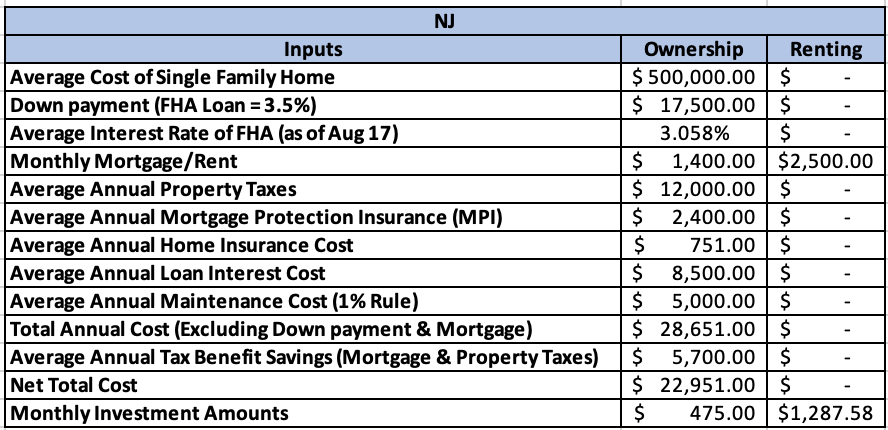

Given that the housing/renting market is different across the nation, we decided to focus in on key three areas that a majority of our audience resides - New Jersey, Maryland & Texas. Since my audience is mainly millennials and young professionals, we focused on the more metro/major city areas of these states. We chose to analyze the results over both a 10 and 30 year period, as this represents the average length of time in a home and the standard mortgage loan period respectively. Given the vast majority of millennial homeowners want a single-family detached home, we assumed this would be the type of home being purchased.

There are many scenarios that we could’ve gone with so we established some assumptions to form a basis for this analysis.

Both individuals in each scenario are earning the same amount in wages.

For the purposes of this scenario, we made rent consistent throughout the time period. This is due to us not considering wage increases that an individual would hypothetically see year over year. We considered these two factors to be net-net. On average, the annual rent increase in the U.S is 3.2% while the average wage increase is between 3-5%. If the wage increases are in line with rent increases, the individual would still be able to afford the rent without impacting the monthly investments.

The investments in these scenarios will be following an S&P 500 Index fund which has experienced a 10% YoY return.

Historically, the average annual home appreciation is roughly 3.5%. This is not considering the outsized home appreciation experienced during the Covid-19 Pandemic.

Despite the tax savings of homeownership being received on an annual basis, this scenario has divided the tax savings and is being invested on a monthly basis. This will make the investment amount slightly inflated due to timing as it relates to homeownership.

In all scenarios, the renters will be investing the downpayment (initial investments) and the monthly cost of homeownership. The cost was determined by taking the Monthly cost of ownership (e.g. mortgage, interest of loan, MPI, Insurance, taxes etc) and subtracting the rent.

The homeowner will not be refinancing their mortgage to get rid of the Mortgage Protection Insurance (MPI) cost.

The homeowner will not be making any additional payments on their mortgage to reduce the loan time-frame/interest.

So lets get into it DWM fam!

New Jersey:

Data Points

The Results

Renters investment value consisted of the following: Initial Deposit of $17,500 and monthly investments of $1,287.58.

Renters investment value consisted of the following: Initial Deposit of $17,500 and monthly investments of $1,287.58.

Maryland Metro Area (DMV):

Data Points

The Results

Renters investment value consisted of the following: Initial Deposit of $12,950 and monthly investments of $741.67.

Renters investment value consisted of the following: Initial Deposit of $12,950 and monthly investments of $741.67.

Texas Metro Areas (Dallas)

Data Points

The Results

Renters investment value consisted of the following: Initial Deposit of $11,025 and monthly investments of $1,145.83.

Renters investment value consisted of the following: Initial Deposit of $11,025 and monthly investments of $1,145.83.

As you can see, five out of the six scenarios show that renters make out better return wise when considering the cost of homeownership. As a reminder, this analysis focused on the cost of homeownership and did not include other disposable income both parties could be investing. To be honest, I am not surprised with the results. However, there isn’t a big difference in return when we are discussing a shorter period of time. So that is something to keep in mind going forward.

Overall, the point of this analysis was really to show that renting can be beneficial to one’s finances. In fact, you can truly build massive wealth as a renter. Whether to rent or own really boils down to one’s preference and what is important to them. Do you value privacy? Are you comfortable with the maintenance of being a homeowner or would you prefer that to be someone else’s problem? Depending on where you are in life- how you value the benefits of being a homeowner vs a renter may look very different. My wife and I aspire to be homeowners one day- but right now I can honestly say that building wealth as a renter works for us.

I encourage you to use this as a basis to any further analysis you perform given some individuals may see some bias in this one. For example, I didn’t consider that property taxes could change overtime or even that home values could easily have another stellar period like the covid-19 pandemic. As always, I want to hear from you! Do these results surprise you? Will this analysis change your perspective on whether or not your rent or own?

Holding You Accountable,

DWM

Sources:

https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator

https://www.investopedia.com/articles/personal-finance/090415/salary-secrets-what-considered-big-raise.asp

https://www.rentcafe.com/blog/rental-market/local-rent-reports/new-jersey-rent-report-june-2019/

https://www.mortgagecalculator.org

https://www.bankrate.com/calculators/mortgages/loan-tax-deduction-calculator.aspx